NEWS

DIFFERENCE BETWEEN NIE, TIE and NIF

10th November 2025What is the difference between NIE, TIE and NIF?

NIE – Foreigner Identification Number

The NIE is the basic identification number that every foreigner needs to carry out official or financial actions in Spain. It is like the national ID number for non-Spanish residents.

Who needs it:

Anyone doing official actions such as buying or renting property, opening a bank account, buying a car, paying taxes, or registering at the town hall.

Format:

Begins with a letter (X, Y or Z), followed by seven digits and a final letter, for example Y1234567A.

What you receive:

It is a paper document, not a card. It includes your name, nationality, and NIE number.

Summary:

Type: identification number for foreigners

Issued by: Spanish police or immigration office

Validity: lifelong

Used for: administration, purchases, taxes, etc.

TIE – Foreigner Identity Card

The TIE is a physical residence card, similar to an ID card, issued to foreigners legally living in Spain for a long period.

Contents:

Photo, personal details, NIE number, and residency status (for example, EU resident).

When obtained:

When a foreigner stays more than three months in Spain and registers as a resident, or has a residence permit.

Summary:

Type: residence card with photo and chip

Contains: NIE number

Issued by: Spanish police

Used for: proving legal residence in Spain

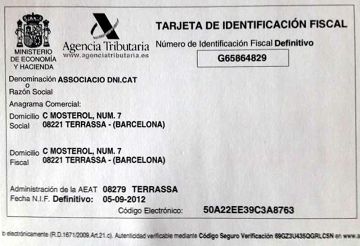

NIF – Tax Identification Number

The NIF is the fiscal number required for everyone in Spain, both Spaniards and foreigners.

For Spaniards: the NIF is their DNI number.

For foreigners: the NIF is the same as their NIE number.

Example:

A Belgian buying a property in Spain obtains a NIE. That same number is used as their NIF for taxes with the Spanish Tax Agency.

Summary:

Type: tax number

For foreigners: same as NIE

Used for: taxes, invoices, property ownership, etc.

General overview:

| Term | Meaning | What it is | For whom | Form |

| NIE | Foreigner Identification Number | Identification number for foreigners | Anyone with official dealings in Spain | Paper document |

| TIE | Foreigner Identity Card | Residence card | Resident foreigners | Plastic card |

| NIF | Tax Identification Number | Tax number | Everyone | Number (for foreigners = NIE) |

Example:

Jan from Belgium buys an apartment in Marbella. He applies for a NIE for the deed and taxes. Later, he registers in Spain and gets a TIE. For taxes, he uses the same number as his NIF.

Recent news

- REAL ESTATE BROKERAGE ANDALUSIA 4th December 2025

- SILENT ACCEPTANCE OF URBANIZATION BY MUNICIPALITIES 4th December 2025

- TRUMP CALLS MERCADONA A CULTURAL PHENOMENON 1st December 2025

- REAL ESTATE BUBBLE 30th November 2025

- DUE DILIGENCE 29th November 2025

- CEMENT CONSUMPTION SPAIN 29th November 2025

- SECOND OCCUPACION LICENCE 20th November 2025

- FOREIGNERS WITH ASSETS IN SPAIN 16th November 2025

- COMPARISON OF WAGES IN FLANDERS AND ANDALUSIA 14th November 2025

Sales and rentals on the Costa Blanca, Costa Calida and Costa Del Sol

Sales and rentals on the Costa Blanca, Costa Calida and Costa Del Sol